Borrowing on new mortgages spiked by £3.2bn in May, as ‘procrastinating’ buyers and sellers decided to take the plunge amid changing market conditions.

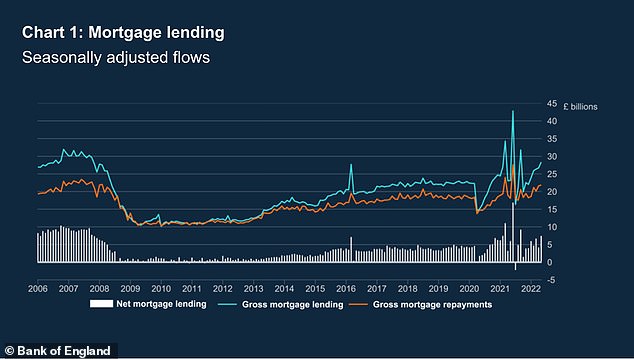

Net borrowing of new mortgage debt increased to £7.4billion in May, according to the Bank of England’s money and credit data, up from £4.2billion in April.

This was also far above the pre-pandemic net average for the 12 months to February 2020, which sat at £4.3billion.

Mortgage mayhem: New borrowing surged £3.2bn in May, according to the BofE, as sellers decided to put their homes on the market before the perceived market peak

The borrowing spike came despite the cost of living crisis, whereby inflation is driving up the price of essentials such as food and fuel, as well as rising mortgage rates via Bank of England base rate rises.

Experts said buyers were seeking to lock in purchases before mortgage rates increased further.

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco, said: ‘May was a crazily busy month on the mortgage front and this data underlines that.

‘A lot of people want to buy before rates rise even further and the “fear of missing out” on the rates currently available is incentivising a lot of people to take action.

Others said that there were more homes available to buy because sellers sensed the peak of the market, and wanted to sell their homes before prices began to reduce.

Borrowing boom: Net borrowing of new mortgage debt increased to £7.4billion in May, the BofE said, up from £4.2billion in April

Tom Bill, head of UK residential research at estate agent Knight Frank, said: ‘There are two reasons that demand for mortgages is holding steady despite the presence of a cost-of-living squeeze that will get worse before it gets better.

‘First, buyers are faced with more choice as a growing number of prospective sellers sense prices may be peaking.

‘Second, with lenders pulling their cheapest products on a weekly basis, there is extra urgency to act sooner rather than later.’

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 13 basis points to 1.95 per cent in May, according to the BofE data.

The rate on the outstanding stock of mortgages ticked up 2 basis points to 2.07 per cent.

Gross lending, which also includes remortgages, rose slightly to £28.4billion in May from £26.7billion in April, while gross repayments rose slightly to £21.8billion in May from £21.6billion in April.

The number of mortgages approved for house purchases ticked up to 66,200 in May, from 66,100 in April.

This was below the 12-month pre-pandemic average up to February 2020 of 66,700.

Approvals for remortgaging were unchanged at 47,800 in May, below the 12-month pre-pandemic average up to February 2020 of 49,500 - but these statistics only reflect those remortgaging with a different lender and the number entering a new deal with their existing lender is likely much higher.

Andrew Burrell, chief property economist at Capital Economics, said: ‘Mortgage approvals remained relatively weak in May supporting our view that higher interest rates are now starting to curb activity.

‘As mortgage rates are set to rise further over the next year, this means demand and lending will stay soft in the coming months.’

Credit cutbacks: The BofE data also showed that people borrowed less on credit cards and personal loans in May than they did in April

Credit card and loan borrowing drops

The BofE data showed that the amount borrowed on credit cards and personal loans decreased by £600million in May compared to April.

Individuals borrowed an additional £0.8billion in consumer credit in May, less than the £1.4billion of new borrowing in April.

This was slightly below the 12-month pre-pandemic average up to February 2020 of £1billion.

The additional consumer credit borrowing in May was split between £0.4 billion on credit cards, and £0.4 billion on other forms of consumer credit such as car dealership finance and personal loans.

Interest rates on new personal loans to individuals fell by 3 basis points to 6.49 per cent in May, 40 basis points below the February 2020 level.

The effective rate on interest-charging credit cards increased by 30 basis points to 18.38 per cent in May from 18.08 per cent in April, and sits 18 basis points below the February 2020 level.

The effective interest rate on interest-charging overdrafts in May increased by 15 basis points to 20.22 per cent.

Households save less as cost of living crisis bites

Households deposited a total of £5.4billion in savings with banks and building societies in May, compared to £5.7billion in April, according to the BofE.

Some £0.3billion was put into National Savings and Investment accounts, compared to £0.6billion in April.

Combined deposits with banks, building societies and NS&I accounts in May were £5.7billion, down from £6.3billion in April but in line with the average of £5.6billion during the 12-month pre-pandemic period up to February 2020.

It is critical that savers consider fixed rate offerings and avoid spending beyond their means if possible

Paul Heywood, chief data and analytics officer at credit union Equifax UK, said: ‘As the cost-of-living crisis further strains household finances, savings and disposable incomes are eroding, causing many people to pay down less debt.

‘Nevertheless, with economists speculating that the base rate may need to rise, with some predicting as high as 3 per cent, to combat soaring inflation, such high-rate hikes will be felt by people across the country as debt repayment becomes much more expensive.

‘With our research indicating that more people in the UK are becoming financially vulnerable, it is critical that savers consider fixed rate offerings and avoid spending beyond their means if possible.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.